Bitrade

Bitrade

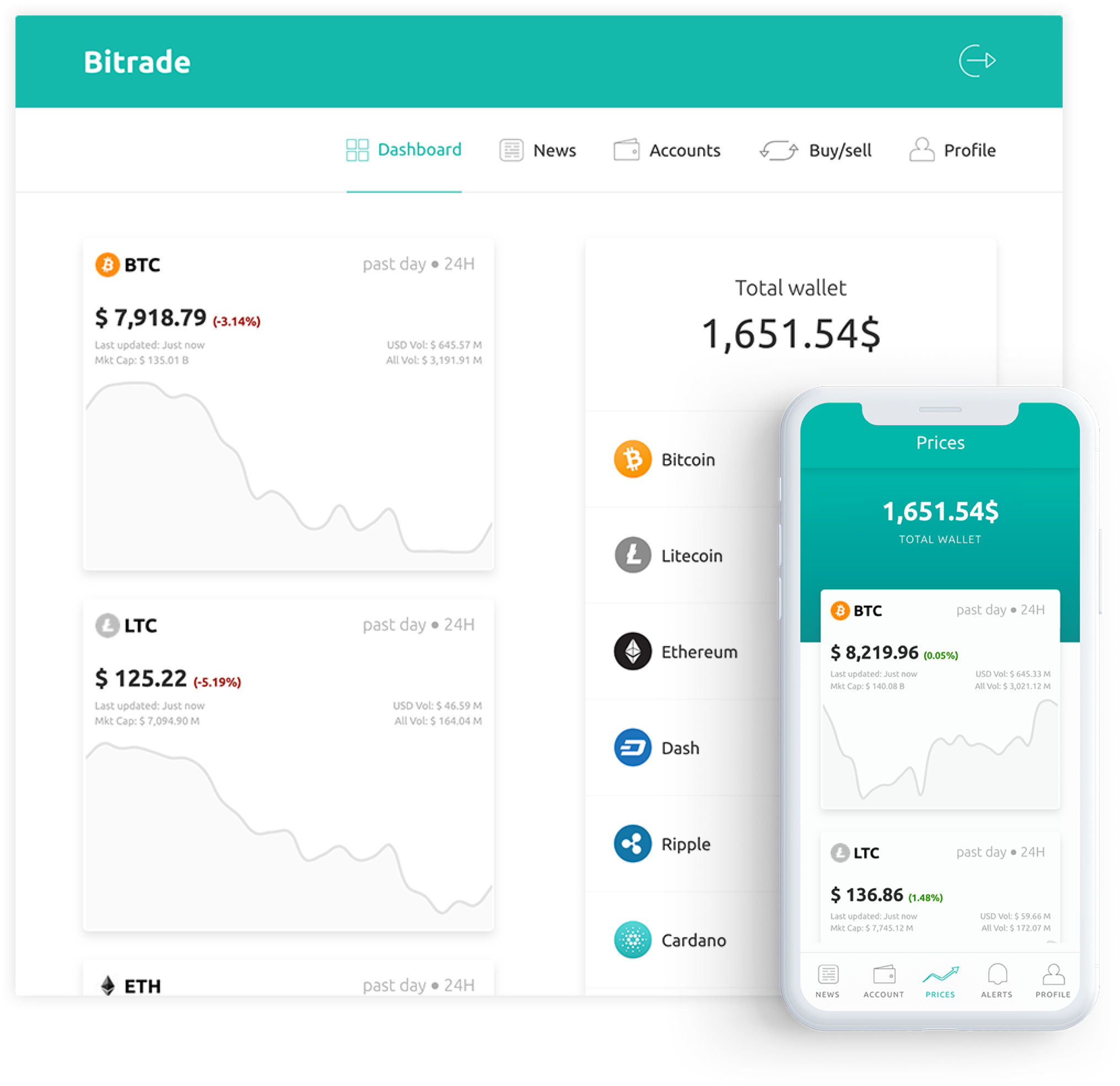

Start trading cryptocurrencies and connect with thousands of traders all over the world. Trading has never be so simple.

Your account has been successfuly created

Bitrade

Trade on many cryptocurrencies

Buy and sell Bitcoin, Ethereum, Litecoin and many more other tokens in the most easy way as possible. Trading has never been so intuitive and simple.

Bitrade

Connect with people worldwide

Share your ideas, information, advices and comments with other traders. Learn from other people and become a successful investor like u never been before.

Bitrade

Store your funds on a secure online wallet

Preserve all your cryptocurrency coins on a secure wallet in 1 click to hold them as long as you want. No need to worry about anything else.

Bitrade

Send and receive cryptocurrencies

Send and receive all over the world no matter where you are, everything is stored in your online wallet. It’s super easy to exchange money where you want.

Sell Bitcoin

Buy Bitcoin

Sell Litecoin

Buy Litecoin

Sell Ethereum

Buy Ethereum

Sell Dash

Buy Dash

Sell Ripple

Buy Ripple

Sell Cardano

Buy Cardano

Sell Stellar

Buy Stellar

Sell Neo

Buy Neo

Withdraw funds

Select the account to use

Deposit funds

Select the account to use

Your order has been successfully done !

Add account

Connect bank

To link your bank account, you need to send 1€ to this account in order to verify yourself. After receiving the wire transfer, we will proceed to a validation and will credit the money on your Dollar wallet. So simple it is !

- Name of receiver Bitrade BEL, Ltd.

- IBAN BE 46 8907 1245 2568

- Name of bank BNP Paribas Fortis

- Address of bank Rue des braises 2, 1000 Bruxelles

- Address of receiver Rue des rifles 46, 1325 Wavre

- SWIFT/BIC GEBABEBB

- Reference number CBYTDG23JFKD37DHF

Connect credit card

To link your credit card, fill in the information bellow. Once connect, you will be allowed to buy immediately cryptocurrencies on your account.

Copied to clipboard !

-

Bitcoin wallet0,2 BTC 800.00$

-

Litecoin wallet0,2 LTC 800.00$

-

Ethereum wallet0,2 ETH 800.00$

-

Dash wallet0,2 DSH 800.00$

-

Ripple wallet0,2 XRP 800.00$

-

Cardano wallet0,2 ADA 800.00$

-

Stellar wallet0,2 XLM 800.00$

-

Neo wallet0,2 NEO 800.00$

-

Dollar wallet800.00$ 800.00$

-

Sébastien SeghersSubscribe @nighahigha 15min ago

Sébastien SeghersSubscribe @nighahigha 15min ago -

Alexandre DunoitSubscribe @thepopup50 20min ago

Alexandre DunoitSubscribe @thepopup50 20min ago -

Didier VanoitSubscribe @didier01 25min ago

Didier VanoitSubscribe @didier01 25min ago -

Victoria SalvaSubscribe @vivi907 55min ago

Victoria SalvaSubscribe @vivi907 55min ago

-

Sébastien SeghersSubscribe @nighahigha 15min ago

Sébastien SeghersSubscribe @nighahigha 15min ago Dylan DuvivierSubscribe @Didivivier 10min ago4 likes 0 responses Like Respond

Dylan DuvivierSubscribe @Didivivier 10min ago4 likes 0 responses Like Respond Jordan ColipsSubscribe @jojo20 5min ago1 likes 0 responses Like Respond

Jordan ColipsSubscribe @jojo20 5min ago1 likes 0 responses Like Respond

-

Alexandre DunoitSubscribe @thepopup50 20min ago

Alexandre DunoitSubscribe @thepopup50 20min ago Hélène SeverainSubscribe @Helena08 10min ago3 likes 0 responses Like Respond

Hélène SeverainSubscribe @Helena08 10min ago3 likes 0 responses Like Respond

-

Didier VanoitSubscribe @didier01 25min ago

Didier VanoitSubscribe @didier01 25min ago Jordan MoroSubscribe @jojomoro 22min ago8 likes 0 responses Like Respond

Jordan MoroSubscribe @jojomoro 22min ago8 likes 0 responses Like Respond Vincent DepréSubscribe @vincounet 18min ago18 likes 1 response Like Respond

Vincent DepréSubscribe @vincounet 18min ago18 likes 1 response Like Respond Didier VanoitSubscribe @didier01 9min ago4 likes 0 responses Like Respond

Didier VanoitSubscribe @didier01 9min ago4 likes 0 responses Like Respond

-

Victoria SalvaSubscribe @vivi907 55min ago

Victoria SalvaSubscribe @vivi907 55min ago Vincent DepréSubscribe @vincounet 41min ago72 likes 0 responses Like Respond

Vincent DepréSubscribe @vincounet 41min ago72 likes 0 responses Like Respond Jordan ColipsSubscribe @jojo20 35min ago21 likes 0 responses Like Respond

Jordan ColipsSubscribe @jojo20 35min ago21 likes 0 responses Like Respond

Write a post

Select a channel

Share this post

About Bitcoin

- What is Bitcoin ?

-

Known variously as a crypto-currency or cyber-currency, Bitcoin is a privately produced monetary asset. It is far from being the first – non-state currencies have existed throughout history. It is not even the first of the online era.

-

But it is by far the best known and most widely used. Learned articles have been written about its operations and its potential impact on the world financial system. Journalists have pursued with terrier-like determination Bitcoin’s mysterious founder, known as Satoshi Nakamoto. So far they have been unsuccessful.

-

Shops, bars, restaurants and other businesses throughout the world have accepted bitcoins in payment for some years, and the total is now thought to be well into six figures.

-

Bitcoin has been denounced by, among others, the Danish national bank, which said bitcoins “are not money in a proper sense” and compared them to glass beads. Meanwhile, fiscal authorities across the world struggle to work out how to tax Bitcoin transactions.

- How does it work ?

-

Bitcoin is created using complex mathematical codes whenever someone exchanges “real” money – pounds, euros, dollars and so forth – for bitcoins using a credit or debit card. The bitcoins are then loaded into an electronic “wallet”, held in a computer or mobile device, and can be used wherever they are accepted in payment.

-

There is no Bitcoin “central bank”. A decentralised network of individuals and companies, known as “miners”, is supplied with new bitcoins by the shadowy founders of the currency and they then release it in return for “real” money.

-

But the supply of new bitcoins is in decline – deliberately. Issue of the currency is capped at 21 million units. After that, no more will be created and the existing supply will rise and fall in line with demand.

-

As Bitcoin says on its website: “Unlike government issued money that can be inflated at will, the supply of Bitcoin is mathematically limited… and that can never be changed.”

-

Similarly, Bitcoin says un-crackable computer codes prevent bitcoins from being faked or forged.

- Why would anyone invest in Bitcoins ?

-

1) As a diversification tool. Bitcoin’s universal nature means it’s not exposed to specific market or economic events.

-

2) As a bet on the future. Bitcoin’s most fervent supporters see it as a liberating force that will break the power of central banks and empower the individual.

-

3) As a hedge against inflation. If someone’s domestic currency is losing its value, Bitcoin may seem an appealing shelter against the inflationary storm.

-

4) As a straightforward investment. Just as not everyone who invests in gold wants to see currencies once again backed by bullion, so some see Bitcoin as an asset, like any other, with the potential to appreciate in value.

- What do I need to know about Bitcoin

-

One of the most important aspects of Bitcoin from an investor perspective is the extreme volatility of its price. It may be forgery and inflation-proof, but it is by no means a reliable store of value.

-

Launched in 2008, reliable figures for the worth of bitcoins are available from mid-2013, when each bitcoin was changing hands at about $85. By December 2013, this had rocketed to more than $800. Anyone who bought at that price was probably feeling pretty sore by January 2015, when bitcoins had slumped to $200.

-

But they should have held on because by the start of 2017, Bitcoin went through the $1,000 barrier and by March was trading at about $1,290. This may have been a sweet moment for Bitcoin’s founders (whoever they are) given that the currency was now more valuable than its venerable alternative as a non-state, non-inflationary asset, gold, which was trading at more $1,200 an ounce.

-

It even shrugged off a refusal on March 10 by the US regulator the Securities and Exchange Commission to allow Bitcoin to have its own exchange-traded funds, which would have let investors buy and sell Bitcoin on the stock market.

-

Bitcoin guarantees the privacy of its users, a cause of concern for law enforcement agencies around the world.

-

There have been systems failures in Bitcoin’s nine-year history, one of the worst having been the apparent theft of bitcoins worth $355 million from Bitcoin exchange MtGox in Tokyo, which later filed for bankruptcy.

-

Shortly afterwards, Flexcoin, a Bitcoin bank, lost almost 1,000 bitcoins in a hacking attack and Bitcoin exchange Poloniex said more than 12 per cent of its reserves had been stolen.

-

But the currency has staunch defenders, including author Brian Patrick Eha, whose 2017 history of Bitcoin, How Money Got Free, declares: “If Bitcoin’s early proponents were united by anything, it was a fierce vision of progress.”

About Litecoin

- What is Litecoin ?

-

One of the world’s top 10 cryptocurrencies, Litecoin (LTC), re-joined the $1 billion market cap club in 2017, after first reaching it in 2013. Litecoin’s infrastructure is very similar to that of Bitcoin and as such, is highly affected by changes in Bitcoin price. Moreover, since it is relatively smaller than Bitcoin, it still hasn’t been adopted by many traders and exchanges. It therefore has great growth potential. Since it was created originally as an offshoot of Bitcoin, its infrastructure, which includes improvements over that of Bitcoin, has received praise for its faster processing times and scalability.

- What drives Litecoin's price ?

-

The cryptocurrency market exists in a realm of its own, and is such, is regularly affected by factors from within. Litecoin was created to be an improved version of Bitcoin, offering faster processing times and a higher number of tokens to eventually be released. While general trends in the cryptocurrency market could affect LTC alongside other currencies, some other factors can affect it specifically. Three notable influencers are:

-

1) Bitcoin: Despite no longer being the only player in the industry, Bitcoin is still the benchmark for cryptocurrencies, and even more so when it comes to Litecoin, due to the similarity in their blockchain technology. Therefore, LTC prices could be buoyed by rising Bitcoin prices.

-

2) Availability: Since cryptocurrencies are bought and sold using various exchanges, and not all services carry all currencies, when a major exchange adds Litecoin to its offering, it could boost its price.

-

3) Sudden demand: Sometimes a certain cryptocurrency experiences a surge in demand. This could be the result of press coverage, a competing currency receiving negative press, or sudden popularity in a new market. For example, in March 2017, Chinese investors suddenly took an interest in Litecoin, causing its price to rise significantly.

- Litecoin: a better bitcoin ?

-

In early 2017, there was a major debate in the Bitcoin community regarding a possible hard fork. Essentially, members of the community were protesting increasingly lower transaction-processing speeds, asking for a change in the underlying blockchain platform. Conservative members of the community were against this change, and the possibility of Bitcoin splitting into two or more currencies emerged. However, since Litecoin was created for better scalability, the solution actually came from a solution that was implemented within the Litecoin code.

-

Litecoin added a mechanism called SegWit, which, in the simplest of terms, makes the Bitcoin blockchain faster. SegWit enables more data-per-block to be processed at a given time, accelerating transaction speeds. Key members of the Bitcoin community have said that SegWit is the solution that will prevent the hard fork and prevent the Bitcoin split, giving Litecoin a seal of approval.

About Ethereum

- What is Ethereum ?

-

Ether (sometimes called Ethereum) is a cryptocurrency, initially meant to be used by developers using the Ethereum blockchain platform. Introduced in 2015, the currency quickly rose in popularity, reaching billions of dollars in market cap and solidifying itself as the second most popular cryptocurrency after Bitcoin. Since sentiment to the cryptocurrency market as a whole is dictated by Bitcoin, the general acceptance of this newer currency could be credited in part to the creators of Bitcoin.

-

Roughly 95% of all global currency has no physical form, and exists digitally. The western world’s gradual transition towards a walletless economy means that the idea of a currency needing physical coins and notes is fading away. As the use of digital currencies becomes more widespread, cryptocurrencies could be accepted as payment by an increasing number of businesses. Therefore, alongside Ether being used for applications made on the Ethereum platform, it might also become widely used as a form of payment.

- What drives Ehtereum's price ?

-

While being affected by many factors, in the past, Ether has been affected by two main forces: Bitcoin and the Ethereum platform. On the Bitcoin front, there could be either a negative correlation or a positive one between the two cryptocurrencies. Since Bitcoin is the weatherbell for sentiment towards the cryptocurrency space, when its price changes due to factors relating to the market as a whole (such as volatility in traditional markets or regulations which influence its acceptance by mainstream traders), Ether could also move in the same direction. On the other hand, if a certain occurrence influences Bitcoin specifically, such as when the SEC denied a Bitcoin-Based ETF in March 2017, the correlation could be negative, causing Ether to rise when the Bitcoin drops.

-

The second force that drives Ether prices is the Ethereum platform. Since Ethereum is a blockchain platform, relying on a code infrastructure, it periodically reaches a milestone known as a “hard fork.” A hard fork is a change in the platform which makes it backwards incompatible, and is supposed to improve it as a whole. If a certain hard fork increases the platform’s security for instance, it could be logical to assume that Ether traders will have more faith in it and demand will increase. On the other hand, if the hard fork damages the platform (like the DAO hard fork, which will be expanded upon later), it could cause prices to drop significantly.

- Ethereum vs Bitcoin

-

There are many similarities between Ether and Bitcoin: They are both blockchain-based cryptocurrencies and could both be mined by users around the world who allocate some of their computing power to process transactions. However, there are also several differences. While the yearly supply of Ether is limited to 18 million a year, Ethereum could theoretically continue to introduce new currency to infinity, making its supply unlimited in the long-run. Bitcoin’s supply on the other hand is finite. Its creators decreed that the final number of Bitcoin will be 21 million. Each year a diminishing amount of Bitcoin is introduced, and it is scheduled to reach the 21 million mark in the year 2140.

-

Another main difference is processing speed. Cryptocurrency transaction require a great deal of computing power to process, and therefore are not done instantaneously. However, while the average Bitcoin transaction can take up to 10 minutes to process, an Ether transaction takes only 15 seconds, contributing to its volatility and liquidity. Lastly, the distribution of each currency differs from one another. While the majority of Bitcoin owners are early adopters who mined the currency in its earliest days, most Ether owners are people who took part in Ethereum’s initial crowdfunding campaign - meaning they purchased their currency, rather than mined it. However, it is predicted that the miner vs. buyer ratio will tip in favor of the miners by 2022.

- History of Ethereum

-

Ether was first introduced in the summer of 2015 as the currency for the Ethereum platform, and was valued at $2.8. Ethereum is a blockchain-based decentralized development platform, which enables its users to create an array of blockchain-based applications. Ether was created to serve as the currency for applications that require a payment method, but later became an investment opportunity for day traders. In June 2016, the DAO hard-fork undermined the currency’s allure, when it was discovered that the platform update left the door open for hackers to seize some $50 million in Ether. The discovery caused Ether prices to drop some 30% in a single day. However, the hack was dealt with, and Ether prices have since recovered reaching an all-time high in March 2017.

- Conclusion: Ethereum could be the next Bitcoin

-

Bitcoin has paved the way for Ether, facing trials and public opinion battles that made the acceptance of Ether smoother. Many traders are considering Ether to be a viable investment option, and some believe it is en-route to becoming the next Bitcoin - perhaps even surpassing it. However, it is important to remember that the Bitcoin market is significantly larger, and has been around for longer, so there might be some time before Ether presents actual competition. And yet, some would say that Ether is the silver to Bitcoin’s gold, solidifying itself as a more affordable option in the same market. Either way, it seems that Ethereum is here to stay, and Ether could continue to grow in popularity and value.

About Dash

- What is Dash ?

-

Dash is one of the world’s top 10 cryptocurrencies, and as of 2017, a member of the $1 billion market cap club. Designed for speed and anonymity, Dash made a name for itself as the cryptocurrency industry expanded, being chosen as a form of payment by many vendors, sometimes replacing Bitcoin (BTC). Created in 2014, when faith in cryptocurrency market hit a low point, Dash was able to weather the storm and establish itself as a legitimate currency.

- What drives Dash's price ?

-

As with most cryptocurrencies, DASH token’s price is affected by internal factors within the cryptocurrency market, especially Bitcoin price fluctuations, since BTC is the largest currency. However, Dash has separated itself from other major currencies with its anonymity, unique governing structure, and quick processing times. Therefore, its movements might not coincide with other currencies on the crypto market. Among other factors, its price could be influenced by:

-

1) Profit-taking: Soon after Dash entered the billion dollar club in May, 2017, it experienced a price drop, moving below the $1 billion threshold. This was a result of traders who were quick to cash in on the milestone.

-

2) Mainstream acceptance: From a practical standpoint, many exchanges and vendors favor Dash over other currencies. Therefore, it is gradually being accepted by more institutions, establishing its legitimacy at an increasing pace.

-

3) AIncreased market competition: The cryptocurrency market is still relatively new, and as the market becomes more mainstream, the direct competition between currencies will increase. In such a situation, Dash could have an advantage over many other currencies.

- Dash: a decentralised autonomous organization

-

Unlike other cryptocurrencies, Dash is a Decentralised Autonomous Organization (DAO). This means that some of the decisions made within the community are put up to a vote, and masternodes, community members who put up 1,000 DASH as collateral and serve as moderators of sorts, receive the opportunity to vote. The tradeoff for this governing system comes in the form of a 10% commission which the Dash organization receives from every block mined. This means that Dash has a steady budget, allocated for hiring programmers, as well as maintaining and developing its software infrastructure.

-

While this could be seen as a downside by cryptocurrency miners, it could actually work in Dash’s benefit in the long run. The DAO system enables Dash users to both enjoy the freedom and anonymity offered by a cryptocurrency, while enabling the community to have more control and security.

-

Another advantage of this system is that it enables the use of masternodes for Dash’s two main products: PrivateSend, which allows users to make transactions in complete anonymity, and InstaSend, which facilitates almost instantaneous transfers of up to 1,000 DASH - an extremely rare feature in the cryptocurrency market.

-

The Dash community is known to be very involved in discussing various aspects of the currency, and is considered the most active cryptocurrency community.

- History of Dash

-

Created in 2014 by Evan Duffield, Dash was originally called XCoin, and was designed first and foremost for speed and anonymity. When it was launched, the cryptocurrency space was overflowing with scams in which people would create currencies, pump up their values, and then abandon them after receiving their money. As a result, there was a lack of faith in cryptocurrencies at the time.

-

XCoin was launched nonetheless, with 1.9 million DASH mined within the first two days. While this rapid mining pace was caused by a technical issue, the Dash community refused any attempts by Duffield to relaunch or rebalance the currency. XCoin was later renamed Darkcoin, and then rebranded again as Dash (short for “digital cash”) in 2015.

-

During its first three years of existence, Dash has made a name for itself as a reliable currency with incredible transaction speeds. It is traded on several exchanges throughout the world, and paired with more than 20 mainstream currencies such as the US Dollar, Euro and others. As of 2017, Dash’s market cap exceeds $1 billion and it accounts for 5% of the global cryptocurrency trading volume.

- Conclusion: Dash uniqueness is his advantage

-

In the ever-growing cryptocurrency market, it is hard for those not belonging in the top three currencies to stand out. Bitcoin was here first, and then Ethereum took the market by storm, so other currencies seem to be in their shadow. However, as the popularity of the top two continues to grow, the market as a whole is beginning to attract more investors and its legitimacy as a mainstream trading opportunity increases. In such a market, it is important to be as-good-as, if not better, than the competition. To that extent, Dash is doing a good job.

-

Dash has created a unique sales proposition for crypto-traders: by creating a unique decentralised governing system, together with developing tools to ensure two of crypto-traders most important demands, speed and anonymity.

-

Moreover, its relatively low coin count of just over 7 million (as opposed to Bitcoin and Ethereum’s counts of 16 and 92 million respectively), coupled with its gradual acceptance by mainstream exchanges, could appeal to a wide range of cryptocurrency traders and investors. Despite being launched in the midst of a cryptocurrency storm, Dash has proved that it is a stable and reliable currency, and could continue to solidify its status as a top cryptocurrency.

About Ripple

- What is Ripple ?

-

XRP is different than other cryptocurrencies, as it was never created to serve as a standalone currency. The currency was created to serve as a moderation layer when making transactions using the Ripple Lab platform. This means it only exists within the platform and is mainly used to cover transaction fees or as a bridge currency. The Ripple Labs protocol has been adopted by well-known financial institutions due to its low operating costs and quick transaction processing. The XRP token does have a life of its own when it comes to cryptocurrency exchanges and has achieved the impressive feat of becoming a top 5 cryptocurrency. Like many other cryptocurrencies it is highly volatile, sometimes showing double-digit fluctuations in a single day.

- What drives Ripple's price ?

-

1) General trends in the cryptocurrency market: Many cryptocurrencies tend to move in tandem and XRP is no exception. XRP prices often relate to other major currencies, such as Bitcoin.

-

2) Mainstream adoption: Ripple Labs’s platform serves the need of many financial organisations and other companies within the industry, therefore, whenever it is adopted by another well-recognised brand, it could contribute to its value.

-

3) Technological development: Ripple Labs is still considered a startup (although the XRP market cap makes it the fifth most valuable startup in the world), and as such, could introduce many innovations, and could even pivot. Since Ripple Lab holds some 61% of all XRP tokens, major changes within the company could have a strong impact on the currency.

- Ripple: disrupting the transaction industry

-

XRP was created for instantaneous, secure multi-currency transactions, based on a blockchain protocol similar to that of Bitcoin. However, unlike Bitcoin, Ripple Labs has its sights set on disrupting the digital payment industry by reducing both processing times and transaction fees. Moreover, XRP can be used to exchange currencies with other tokens of value, such as frequent flyer miles or mobile phone minutes, using the token as a moderating currency. Since it is in constant use, there is a relatively large number of XRP in circulation, totalling at more than 30 billion tokens.

-

Ripple Lab’s success is undeniable, with dozens of banks using its services, including international brands such as Bank of America and Santander. While its market cap is in the Billions, the majority of the currency is held by Ripple Labs, which gives it great control over its value. For example, if Ripple Labs decide to raise capital by selling XRP tokens, this could cause a tremendous shift in XRP price, as the market will be flooded with new tokens. However, Ripple Lab CEO Brad Garlinghouse has said that to avoid surprising investors, the introduction of new coins into circulation will be made gradually and with advanced notice.

-

It’s important to note that XRP’s purpose is a lot more practical than that of Bitcoin. While Bitcoin is mainly seen as an investment tool presently, with its buyers mainly using it as a means of making a profit, Ripple Lab’s XRP token is in constant use on its platform. Therefore, as more and more organisations adopt the platform to conduct business transactions, the token’s price could stabilise and become less volatile.

- History of Ripple

-

XRP’s origins date as far back as 2004, when Canadian developer Ryan Fugger created RipplePay, a decentralised monetary system aimed at enabling communities to create their own money. Several years later, a new system was built based on Fugger’s concepts, called OpenCoin. This system enabled quick processing of transactions while consuming less electricity than Bitcoin’s blockchain platform. Any two parties could exchange any currency, including tokens such as frequent flyer miles.

-

After being incorporated, OpenCoin changed its name to Ripple Labs and soon after started focusing on the banking sector. The Ripple Labs platform enabled banks to process transactions in a fast and secure manner while keeping costs lower. The XRP coin was used on these platforms as a moderating currency when conducting transactions, and the majority of its supply is still being held by Ripple Labs.

-

XRP’s market cap increased gradually, until skyrocketing as part of the cryptocurrency boom of May 2017, when it crossed the $10 billion mark for the first time. XRP has established itself as top 5 cryptocurrency.

- Conclusion: Ripple strengh is in it's functionality

-

With so many cryptocurrencies being created in the past few years, the question of their longevity is highly debated. However, XRP is not at risk of fading away, since its platform is used by major financial institutions, with more constantly implementing its services. This is not necessarily a key factor influencing the XRP currency’s strength, but rather, its stability.

-

However, when combining its stability with the increasing popularity of the major cryptocurrencies, and considering these currencies often move in conjunction, it could be safe to assume that XRP by Ripple Labs will remain an alluring investment opportunity. Moreover, the fact that it is in constant use gives it liquidity that is rarely seen in the cryptocurrency market.

About Cardano

- What is Cardano ?

-

Cardano is a decentralized public blockchain and cryptocurrency project and is a fully open source. Cardano is developing a smart contract platform which seeks to deliver more advanced features than any protocol previously developed. It is the first blockchain platform to evolve out of a scientific philosophy and a research-first driven approach. The development team consists of a large global collective of expert engineers and researchers.

-

This is the first blockchain project to be developed from a scientific philosophy, and the only one to be designed and built by a global team of leading academics and engineers. It is essential that the technology is secure, flexible and scalable for use by many millions of users. Consequently, considerable thought and care from some of the leading experts in their fields has been devoted to the project and informed design decisions. The scientific rigor applied to mission-critical systems such as aerospace and banking has been brought to the field of cryptocurrencies, with a high assurance implementation.

- How does Cardano work ?

-

Cardano is being developed in two layers that separate the ledger of account values from the reason why values are moved from one account to the other. This separation enables the smart contracts that are written on the platform to be more flexible.

-

Businesses can take advantage of this separation to tailor the design, privacy, and execution of each contract to more perfectly fit their specific use-cases.

-

Instead of using a Proof-of-Work (PoW) consensus algorithm, Cardano uses the Ouroboros Proof-of-Stake (PoS) algorithm to reach consensus on the state of the ledger. In this protocol, slot leaders generate new blocks in the blockchain and verify the transactions. Anyone holding a Cardano ADA coin can become a slot leader. When the “Follow the Satoshi” algorithm selects a coin that you hold, you can become a slot leader and publish new blocks to the network.

- Cardano: thoughts

-

Cardano is an ambitious project tackling a large number of problems in the crypto industry. After seeing the potential security flaws of Ethereum through the DAO hack and recent Parity wallet fiasco, it’s nice to see that Cardano has a focus on code scrutiny and peer-reviewed security measures.

-

The sheer scope of the project could be lethal to the project, as it leaves a lot of opportunity for error. However, Charles Hoskinson at the helm does help instill some confidence that the team can handle a project of this magnitude.

About Stellar

- What is Stellar ?

-

Stellar is a platform created to serve financial needs, such as money transfers, micropayments and delivering remittances, as well as exchanging different currencies, cryptocurrencies and other tokens. Based on the Ripple Labs protocol, and later forking into its own platform, Stellar operates as a nonprofit organization, with some well known people from the tech space at the helm. So what is the Stellar coin? Like the Ripple Labs’ XRP token, the Stellar token, known as Lumen (or XLM) has very low individual value. However, the overall market cap of XLM positions Stellar as one of the top cryptocurrencies in the world. Stellar’s approach is quite different than other cryptos, since some of its declared missions include fighting poverty and providing financial solutions for bankless individuals.

- What drives Stellar's price ?

-

Like so many other cryptocurrencies, Stellar burst onto the scene in 2017, showing massive gains and reaching a market cap in the billions. While fueled by the crypto bull run, there are other various factors that could impact the XLM coin price. Since it was created first and foremost to support real-world applications, its price is exposed to both crypto-related and non crypto-related influencers:

-

1) Bitcoin: The first cryptocurrency still has a firm grip on the market. Despite hundreds of new altcoins introduced since its launch, Bitcoin is still the most influential crypto, and when it shows volatility, it could often stir the entire market with it.

-

2) XRP by Ripple Labs: Since the way how Stellar works is similar to the Ripple Labs protocol, it is reasonable to believe that the two are perceived as linked by some investors. Therefore, news or price movements relating to one, could impact the other.

-

3) Mainstream adoption: The Stellar protocol could be used for various financial applications. Therefore, whenever it is adopted by a well-known company, it could increase its credibility and might result in an increase in Stellar Lumens price.

-

4) Social impact: One of Stellar’s main agendas is to help the less privileged gain access to financial services. Therefore, the organization’s success could come in ways other than financial gain, such as showing progress in promoting social change.

- The Stellar protocol: Making money smarter

-

The Stellar protocol enables the transfer and exchange of different currencies and cryptocurrencies, using Lumens as a bridging currency. Moreover, since it is blockchain-based, it is also built in a way that ensures parties on both sides will get the best exchange rate possible. The platform automatically locates the best rate for each transaction and charges XLM fractions as a fee, resulting in each transaction costing less than a cent in commission.

-

Therefore, it has attracted quite a lot of attention in the tech and financial world, securing some interesting partnerships. For example, IBM has chosen Stellar as the platform on which to base its cross-border payment solution. The solution aims to drastically reduce the time it takes to transfer money from one country to another, and has garnered attention from some major financial institutions.

- History of Stellar

-

Stellar was founded in 2014, supported by the nonprofit organization, Stellar Development Foundation. The founding members of Stellar are far from anonymous in the tech world. The co-founders are Jed McCaleb, founder of the popular P2P file-sharing solution, eDonkey, and Joyce Kim, a veteran venture capital executive.

-

Originally based on the Ripple Lab protocol, the network later forked into its own formation. In 2015, Stellar underwent a complete overhaul, changing its base code and creating an entirely new server-based consensus algorithm for approving transactions. Each server on the network can approve transactions every 2-5 seconds and and each change is logged on a public ledger updated at the same rate. This ensures both fast transaction times and real-time tracking of each XLM token’s owner.

-

Like many other cryptocurrencies, Stellar had a stellar year in 2017, dramatically rising in value and reaching a market cap in the billions of dollars, positioning itself as a top 10 cryptocurrency.

- Conclusion: Stellar could harness blockchain for good

-

In the fast paced multi-billion dollar cryptocurrency space, Stellar is somewhat of an oddball. It does have similarities to other blockchain companies, such as Ripple Labs and Ethereum, but it functions as a nonprofit, and actively works to promote social change. When put together with its growing capital, efficient money transferring technology, and big name partnerships, Stellar’s path could be quite promising.

-

The cryptocurrency revolution had another, major side effect, namely, to put the spotlight on blockchain technology. While the financial world was interested in e crypto coins, the tech world was fascinated by the possibilities of using blockchain for other purposes. Companies like Stellar, Ripple Labs, Ethereum and NEO all championed the use of blockchain for a variety of applications, and their cryptocurrency value subsequently rose. Stellar is one of the companies that has more to offer than just an investment option, and, therefore, could stay more relevant in the coming years.

About Neo

- What is Neo ?

-

Created by the Chinese company Onchain, NEO was the first cryptocurrency to be launched in China. It is similar to Ethereum in that it was developed to enable the creation of various blockchain applications, and not just as a cryptocurrency. However, the way how NEO works differs from Ethereum and other cryptocurrencies in many ways. Most prominent is the fact that it is not decentralized and cannot fork. The creator of NEO, Da Hongfei, built it to be able to comply with Chinese regulations and coded it in such a way that enables the entire network to be changed or upgraded at once, without the need for user consensus. Looking at the NEO chart, it is apparent that its strong infrastructure and growing number of partners in China has made it a top 10 cryptocurrency, boasting a market cap in the billions.

- What drives Neo's price ?

-

Like many cryptos, NEO had a breakout year in 2017, rising thousands of percents and positioning itself as one of the world’s largest cryptocurrencies by market cap. Since it is not decentralized and cannot be divided (the smallest unit of the currency is one NEO), it has more stability and is designed to experience less latency. However, like all digital assets, it is exposed to various factors that could generate volatility. Among these factors are:

-

1) Hard-capped supply: The entire supply of NEO tokens is limited to 100,000,000. After all of the tokens enter circulation, there will be no more new tokens mined or introduced. Therefore, if demand increases, the limited supply could contribute to rising prices.

-

2) Bitcoin: For better or worse, Bitcoin is still considered the bellwether of the cryptocurrency market, and can often influence the majority of the market. If Bitcoin is on a bull run, other cryptos often follow suit, and if it turns bearish, it could drag other cryptos, including NEO, down with it.

-

3) The Chinese government: In late 2017 and early 2018, the Chinese government began to crack down on cryptocurrency exchanges. Back then, roughly 75% of all Bitcoin trading was done in China, so China’s declared and rumored intents to heavily regulate Bitcoin trading was one of the factors BTC prices were dropping. However, since NEO was designed to comply with Chinese regulations, it could actually benefit if the Chinese government continues to impose sanctions on other cryptos.

-

4) Non-financial applications: The NEO blockchain platform could be used for creating a myriad of applications, such as identity-theft prevention, supply chain monitoring and many others. Since these applications by default use the NEO token as their in app currency, further development of this aspect of the platform could contribute to the token’s demand.

- Neo: The chinese connection

-

During times of uncertainty in the cryptocurrency market in Asia, NEO could have the upper hand. A significant part of the unprecedented crypto bull run in 2017 was fueled by Chinese and South Korean traders. However, the governments of these respective countries were unhappy with the unregulated market and took some extreme measures to curb its expansion. This resulted in panic in the crypto market and hundreds of billions of dollars were wiped off the market in late 2017.

-

However, during the same time, NEO began rising through the ranks, reaching a market cap in the billions and positioned itself as a prominent cryptocurrency. This could be attributed to the fact that it is Chinese government-friendly by design. It is no secret that China favors companies that comply with its regulations, which is why so many local companies, such as WeChat and Alibaba succeeded where their foreign counterparts, such as Facebook and Amazon, failed.

- History of Neo

-

Onchain was founded in 2014 by Da Hongfei, and originally launched the NEO platform under the name AntShares. It was designed to enable the creation of blockchain applications and smart contracts, and its network can process up to 10,000 transactions per second. It was modeled similarly to Ethereum, although its management system is more centralized and it cannot fork. So what is the NEO cryptocurrency? While not completely decentralised, NEO holders can still vote on various issues regarding the platform. Each NEO token is representative of one share, or vote, in the market (similar to shares in a company), which is why the token cannot be divided.

-

Alongside the NEO token, Onchain released another token called NeoGas (or GAS). While NEO is the management token, giving its holders voting rights, GAS is the operational token, used for running the NeoContract system. NEO holders receive a small daily dividend in GAS.

-

Fifty percent of the 100,000,000 NEO tokens were pre mined by its founders and used to pay programmers and other suppliers, while the rest were gradually introduced into the system. In 2017, in the heat of the crypto bull run, NEO skyrocketed some 10,000% and became a multi-billion, top 10 cryptocurrency.

- Conclusion: Neo could be China's star

-

The NEO token benefitted twice in 2017: once when joining the rest of the altcoin market as part of the crypto bull run, and then again by not being targeted by the Chinese government. If the Chinese crackdown on cryptocurrencies continues, while NEO continues to strike strategic partnerships in the country and continues to comply with regulations, the cryptocurrency could only benefit. Not only will it be allowed to operate freely where some of its counterparts have been restricted, it could also receive support from the government, since China often assists and encourages local businesses that fit its economic policies.

Learn trading

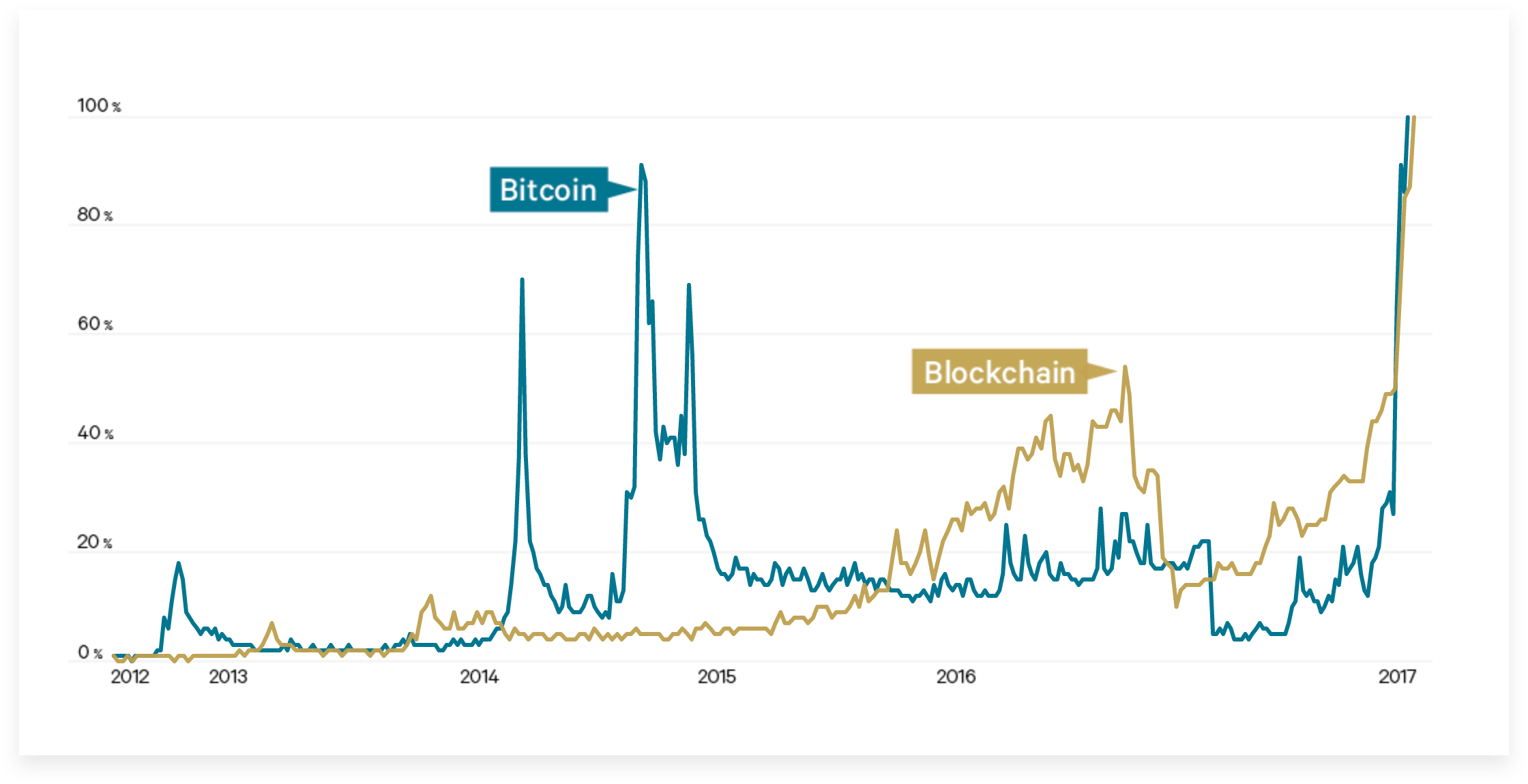

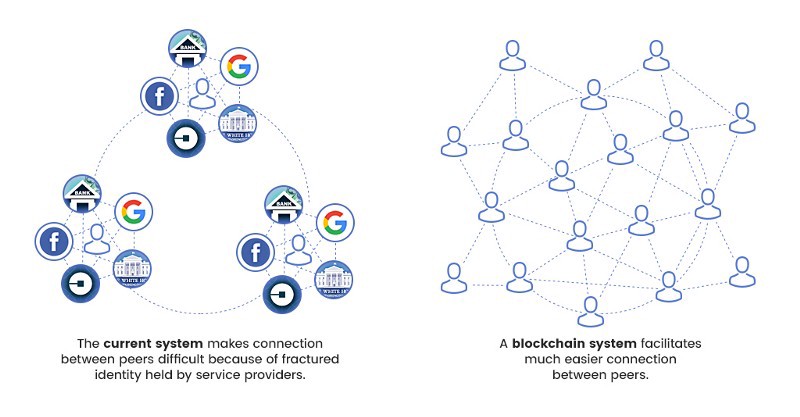

- 1) Learn how blockchain works

-

Goldman Sachs says blockchain technology “has the potential to redefine transactions” and will “change everything”. But anyone who claims to fully understand how blockchain works, and is not named Satoshi Nakamoto, is probably lying to you. And anyone who claims to be Nakamoto himself, is probably also lying to you. Fortunately, just like the internet, you don’t need to know how blockchain works to use it.

-

But here are the basics… a blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography. By design, blockchains are inherently resistant to modification of the data, and serve as a public ledger of transactions between two parties. To date, the best analogy we’ve heard for blockchain compares it to a Google Doc:

-

“The traditional way of sharing documents with collaboration is to send a Microsoft Word document to another recipient, and ask them to save the document, make revisions to it, and send it back. The problem with this scenario was that you needed to wait to receive a return copy before you could see or make changes to the document. You are locked out of editing it until the other person is done with it. That’s how banks work today—they maintain money balances and transfer money by briefly locking access to the account (or decreasing the balance) while they make the transfer, then they update the other side, then re-open access (or update the balance).

-

With a Google Doc, all parties have access to the same document at the same time, and the most up-to-date version of that document is always visible and editable to all parties. This real-time shared Google Doc is just like a distributed blockchain ledger. The “real version” of the transaction is verified by analyzing all the available blocks on multiple computers and taking “the average”.

-

The decentralized and transparent nature is what makes blockchain highly secure and almost impossible to hack, because a hack to one ledger would cause a discrepancy in the entire network that will be ignored. Functionally, to hack the ledger one would have to hack all the computers on a network at the exact same time in order to change the “average”. For a currency like bitcoin, this would mean millions of computers. So the larger the network, the more stable the currency.

-

- 2) Learn the top cryptocurrencies

-

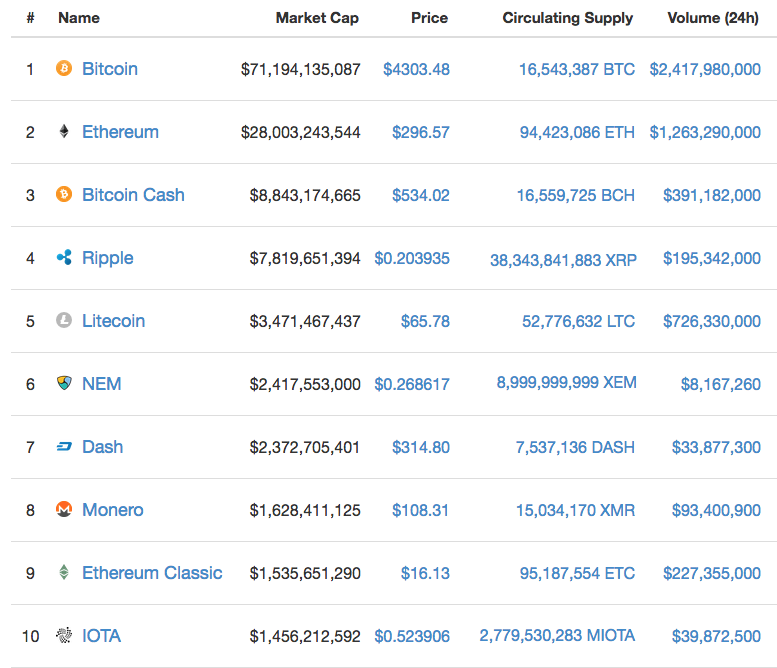

Bitcoin is here to stay. But the world of virtual currencies is getting crowded with many other “altcoins”. There are over 100 types of cryptocurrency that sell for more than $1 USD, according to CoinMarketCap. Even more are in penny-stock range, but I don’t recommend trading them right now.

-

-

What’s important to note is that bitcoin accounts for about 50% of the entire cryptocurrency market, and has the highest volume. It is undoubtedly the most important currency today. You’ll also notice a difference between the original version of bitcoin, Bitcoin Classic (BTC), and a newer version of bitcoin, Bitcoin Cash (BCH). Bitcoin Cash is a spinoff off of the original bitcoin blockchain. we’re not going to get into the technical differences between Bitcoin Classic and Bitcoin Cash, but understand they are separate currencies. So far, Bitcoin Classic seems to be favored by the public over Bitcoin Cash, and has an 8X higher market cap. But when people say “bitcoin” (lowercase) they could be referring to to either currency.

-

The other two currencies we would pay attention to are Ethereum (~40% the size of Bitcoin, also known as “Ether”), and the smaller and more volatile Ripple and Litecoin. Despite a smaller market cap, Litecoin enjoys higher trading volume than Bitcoin Cash and Ripple, likely because it’s one of the three currencies accepted by the #1 digital currency wallet, Coinbase.

- 3) Understand all inherent risks

-

Bitcoin is more volatile than practically any other type of asset, including gold or the stock market. Cryptocurrency is still a young technology, and faces many challenges. While we believe the overall trend for bitcoin is upwards, trading this currency comes with considerable risk. Bitcoin prices are highly impacted by public sentiment about the currency. It will continue to fluctuate as companies and financial institutions make decisions of how to incorporate (or not incorporate) it into their businesses and workflow. It’s also highly sensitive to regulatory changes, as we will get to in a minute.

-

To give an example, in early June 2017, Bitcoin was trading at $2,983, before losing 30% of its value a month later in July—crashing to $1,992. Then it climbed up to $4,764 in September, posting an impressive 139% gain.

-

-

There is also risk inherent to the exchange itself. Just like the cash in your wallet, the safety of your bitcoins or other currencies depend on your own diligence. While your bitcoins cannot disappear, the transactions are permanent and can only be refunded by the recipient. This means you should only do business with people and organizations you know and trust, or who have an established reputation.

-

Remember, bitcoin transactions are stored publicly and permanently on a network, which means that anyone can see the balance and transactions of any bitcoin address. However, only the bitcoin exchanges and/or the parties involved in the transaction can attach the addresses to a real person. So for the most part, the transactions are anonymous.

- 4) Read Cryptocurrency news everyday

-

It is very important to keep inform on what's happening every day, all over the world. Cryptocurrency market is changing by the hour, and things change as fast as we can't imagine. So the best behavior is to read some articles on the web, stay connect on social media and most of all, follow projects and people that influence the cryptocurrency market. A simple information can make a coin dive and crash or rise like hell.

-

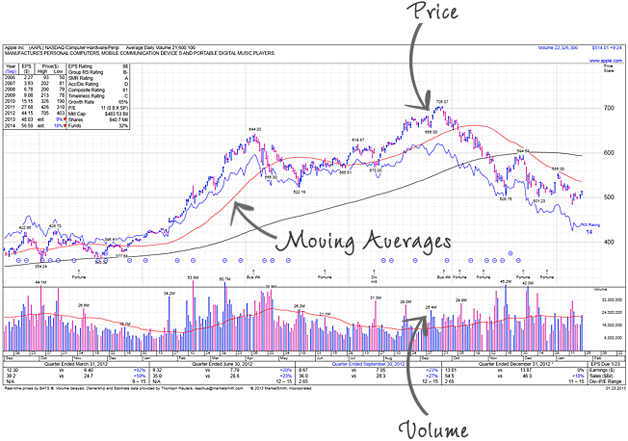

- 5) Study charts to find trends

-

If you believe that bitcoin and the entire market capitalization of cryptocurrencies will increase in value over time, then the goal is to collect as many coins as possible, getting in at the right prices, and build a strong diversified portfolio of crypto assets that you can hold.

-

In order to do this, you must “buy the lows” and let the profits run. we'd recommend entering and exiting positions gradually in case the lows get lower or the highs get higher. Avoid buying/selling in big emotional or reactionary swoops, and try not to trade more than a few times a week to keep fees down and give your bets a chance to perform.

-

One way to tell if a stock price is over/undervalued is by reading moving averages. Moving averages are plotted on stock charts to help smooth out volatility and point out the direction a stock may be trending. As short-term moving averages (red line below) cross over long-term moving averages (black line), this sometimes is followed by accelerated movement in the price. Also pay attention to spikes in trade volume, as this may imply that strong sentiments of fear or excitement just entered the market.

-

-

There are many other strategies traders use to predict trends, which we won’t get into today. These include Head and Shoulders, Trend Lines, Support and Resistance patterns and Candlesticks. Here’s a great article explaining each of these in a little more detail. Within the GDAX dashboard, you will find a price chart that looks similar to the one above, accompanied by four other sections in the same viewport:

-

5.1) The Price Chart in GDAX shows historical prices and volume data in two views: a line chart and candlestick chart (recommended) over various historical time frames.

-

5.2) The Depth Chart right below the Price Chart shows a detailed visual representation of the bid and ask prices over a range of prices. You can increase or decrease the price range for the chart by using the plus or minus buttons at the top of the chart. The price in the middle of the chart is the midpoint price between the best bid and ask prices. Moving the cursor over the prices will allow you to select a price in which you can create an order. Clicking the price will fill in the buy/sell price for you automatically in the left sidebar. This chart is a useful to see how close buyers are from sellers in their ask/bid prices; the greater the surface area under the curve, the more bids there are at that price.

-

5.3) The Order Book shows a live view of open orders on the entire Coinbase exchange, in what’s called an order ladder. There are three columns that show the market size, price and order size of each order. You can click any row and it will fill in the buy/sell price for you automatically in the left sidebar. Once you confirm the order, it will immediately show up on the order ladder and attempt to get filled.

-

5.4) The Open Orders section shows status of each of your open orders. It also shows filled orders. You can easily cancel any order at any time.

-

5.5) The Trade History on the right shows all completed orders.

-

On the upper-left (below) you will see a dropdown to change the currency, with nine different options. The most common views will be BTC/USD (Bitcoin), ETH/USD (Ethereum) and LTC/USD (Litecoin).

-

-

The primary goal of these charts is to determine the general direction of the currency over a specified time period, and the prices at which you would be willing to buy and/or sell the currency before it takes a correction.

-

It’s important to specify a time horizon for your investment—such as short term (7–14 days), medium term (1–2 months) or long-term (6–12 months). I don’t recommend trading on time horizons shorter than 7 days unless you have access to margin (you probably don’t) or have large amounts of money to play with; otherwise, the fees will be too high relative to the returns.

- 6) Set limit orders and be patient

-

Once you are ready to place an order, you will accept the market price or set what’s called a limit order. Limit orders provide investors and traders with a means of precisely entering a position without being victim of fluctuating prices. For example, a buy limit order can be place for $2.40 when a stock is trading around $2.50. If the price dips to $2.40, the order is automatically executed. If it’s a GTC (good ’til canceled) order, it will remain open until manually cancelled by the investor.

-

Once the limit order is set, be patient. Give the price time to fluctuate—testing highs and lows—and see if your limit order catches a buyer (or seller). There is no hurry to cancel you limit orders, so resist the urge to rapidly change your limit order prices. Many experienced investors will set multiple limit orders at consecutively lower prices to take advantage of a big selloff or take some profits when the price tests a new high. Limit orders are your best friend, use them.

- 7) Conclusion

-

One advice we'd give beginner traders is to avoid falling for ICOs, or Initial Coin Offerings, in the short term and stick with the more established currencies like Bitcoin, Eurotheum and Litecoin. According to MarketWatch, an ICO is “a fundraising means in which a company attracts investors looking for the next big crypto score by releasing its own digital currency in exchange.” The ICO is similar to a initial public offering (IPO), but with a crypto twist and (as of now) no regulatory hoops to jump through.

-

A total of $1.6 billion have been globally raised via ICOs already, but as we mentioned, ICOs were recently banned in China, so the Securities and Exchange Commission (SEC) is receiving immense pressure to propose similar rules to regulate the ICO phenomenon as well. So any US-based companies planning their ICO might want to reconsider. You can find a comprehensive list of upcoming ICOs on CoinSchedule.com, although we recommend that you look but don’t touch. Now it not the time for ICOs.

-

For more information about ICOs in the US market, check out “Around the Coin” fintech podcast with Faisal Khan and Mike Jones, CEO of Science Inc, who talks about their $50M blockchain fund ICO coming later this year.

-

Bitcoin, Ethereum and Litecoin have enjoyed some of the highest returns in modern investment history (Litecoin +1,762.97% since last year), so there’s really no reason not to trade them. If you’re patient and disciplined, you will have a good shot at making money, or at least have some fun trading.

-

Sébastien Seghers @nighahigha0 followers 0 subscriptionsInformation

Sébastien Seghers @nighahigha0 followers 0 subscriptionsInformation -

Options

-

Linked accountsAll my accounts

Select the account to use -

Historic of trades

- Deposit 1,000.00€ on EUR account 24/03/2018 | 12pm

- Withdraw 600.56€ on EUR account 12/03/2018 | 8pm

- Buy 12,5 Litecoin (LTC) (1,457.78€) 16/02/2018 | 5am

- Sell 1,5 Ethereum (ETH) (1,145.91€) 19/01/2018 | 10am

-

Trading tutorial

-

My personal posts

-

adminSubscribe @admin 15min ago

adminSubscribe @admin 15min ago -

adminSubscribe @admin 2 weeks ago

adminSubscribe @admin 2 weeks ago

-